Exness is a global Forex and CFD broker founded in 2008, widely known for its transparency, advanced trading technology, and strong regulatory compliance. For international traders, regulation is a critical factor when choosing a broker. Understanding how Exness is regulated and what its licenses actually mean helps traders evaluate safety, fund protection, and long-term reliability. This article explains Exness regulation under FCA, CySEC, and FSA in a clear and practical way.

Why Regulation Matters in Forex Trading

Forex and CFD trading involves leveraged products, which makes broker regulation essential for protecting traders from fraud, unfair practices, and financial misconduct.

The Role of Financial Regulators

Financial regulators establish rules that brokers must follow to operate legally. These rules cover capital requirements, client fund segregation, risk management, and fair trading practices. A regulated broker is subject to regular supervision and penalties if it violates regulatory standards.

How Regulation Protects Traders

Regulation helps ensure that client funds are handled securely and that brokers operate transparently. Licensed brokers must maintain financial stability, disclose trading conditions clearly, and provide mechanisms to protect retail traders from excessive risk.

Overview of Exness Regulatory Structure

Exness operates through multiple licensed entities across different jurisdictions to legally serve traders worldwide. This multi-entity structure allows Exness to comply with regional regulations while maintaining consistent trading standards globally.

Exness Headquarters and Licensing Model

Exness is headquartered in Cyprus, a major European financial hub. From this base, the company manages compliance, risk controls, and global strategy. Each regional entity operates under the supervision of a recognized financial authority.

Key Regulatory Authorities Supervising Exness

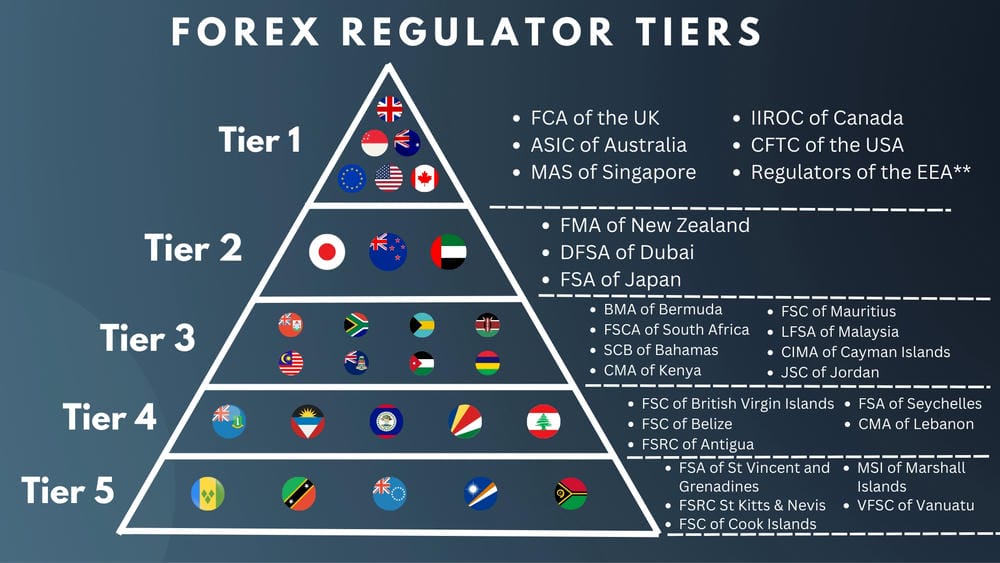

The main regulators overseeing Exness include the UK Financial Conduct Authority, the Cyprus Securities and Exchange Commission, and the Seychelles Financial Services Authority. Each regulator plays a distinct role in ensuring broker integrity and client protection.

FCA Regulation and Its Significance

The UK Financial Conduct Authority is one of the most respected financial regulators in the world, known for its strict oversight and enforcement.

FCA Licensing Standards

FCA-regulated brokers must meet high capital adequacy requirements, implement strict internal controls, and follow detailed reporting obligations. These standards significantly reduce the risk of broker insolvency or misconduct.

What FCA Regulation Means for Traders

For traders, FCA regulation provides a high level of confidence. It ensures transparent operations, fair treatment of clients, and strong consumer protection rules, making FCA oversight a major trust signal for Exness users.

CySEC Regulation and European Compliance

CySEC is the primary financial regulator in Cyprus and one of the most influential authorities within the European Union.

CySEC Requirements for Forex Brokers

CySEC-regulated brokers must comply with European financial directives, including rules on client fund segregation, leverage limits for retail traders, and disclosure of trading risks. Regular audits and compliance checks are mandatory.

Benefits of CySEC Regulation for Global Traders

CySEC regulation allows Exness to legally offer services across many international markets. It also ensures that traders benefit from EU-level consumer protection standards and transparent business practices.

FSA Regulation and Offshore Oversight

The Seychelles Financial Services Authority supervises Exness entities serving international clients outside Europe and the UK.

FSA Licensing Framework

FSA regulation focuses on operational transparency, risk management, and financial reporting. While its requirements are more flexible than those of FCA or CySEC, licensed brokers must still meet defined compliance standards.

Why FSA Regulation Still Matters

For global traders, FSA oversight ensures that Exness operates legally in offshore markets while maintaining consistent trading conditions, fast execution, and reliable withdrawals.

Additional Safety Measures Beyond Regulation

Regulation alone is not the only factor that determines broker safety. Exness implements additional internal policies to enhance trader protection.

Segregated Client Accounts

Exness keeps client funds in segregated accounts, separate from company operating capital. This structure protects trader deposits and prevents misuse of funds.

Negative Balance Protection and Audits

Exness provides negative balance protection, ensuring traders cannot lose more than their deposited amount. The broker also undergoes regular independent audits, which further enhance transparency and trust.

In conclusion, Exness regulation under FCA, CySEC, and FSA demonstrates a strong commitment to legal compliance, transparency, and trader protection. Its multi-regulatory framework, combined with segregated funds, negative balance protection, and independent audits, positions Exness as a secure and reputable Forex broker. For traders seeking a globally regulated platform with proven reliability, Exness continues to be a trusted choice in the international Forex and CFD market.